Back

2 Feb 2023

Crude Oil Futures: Extra losses in the pipeline

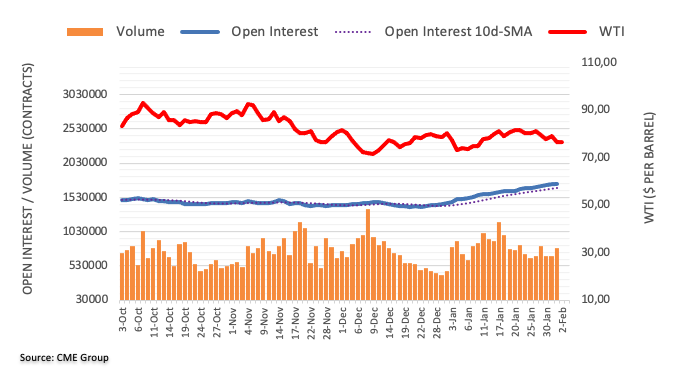

Considering advanced figures from CME Group for crude oil futures markets, open interest increased for yet another session on Wednesday, this time by nearly 3K contracts. In the same line, volume added to the previous build and went up by around 111.2K contracts.

WTI could debilitate to $72.50

Prices of the barrel of the WTI resumed the weekly decline on Wednesday. The downtick was in tandem with rising open interest and volume and exposes a deeper retracement in the very near term. Against that, the next contention of note emerges at the so far 2023 low at $72.50 (January 5).