Back

9 Feb 2023

Crude Oil Futures: Scope for further gains near term

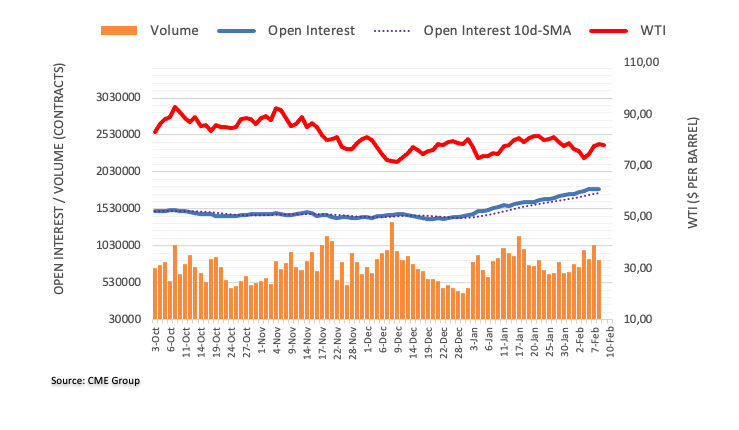

CME Group’s flash data for crude oil futures markets noted traders added around 4.3K contracts to their open interest positions on Wednesday, reversing the previous daily drop and resuming the uptrend at the same time. Volume, instead, kept the erratic performance and shrank by around 201.1K contracts.

WTI: A retest of the 2023 low appears likely

Prices of the barrel of the WTI rose further north of the $78.00 mark on Wednesday. The move was supported by rising open interest, which leaves the door open for the continuation of this uptrend in the very near term. The marked drop in volume, however, prompts some caution and could spark a corrective decline with the next target at the YTD low near $72.00 (February 6).