US Dollar apathetic near 100.80 post-US data

The US Dollar Index – which gauges the buck vs. its rival peers – keeps the negative ground on Thursday around the 100.80 area despite upbeat US releases.

US Dollar muted on data

The index stayed pretty much unchanged after auspicious results from the US docket saw Initial Claims rising to 239K WoW (vs. 245K exp.), taking the 4-Week Average to 245.25K from 244.75K.

Further positive results showed both Building Permits and Housing Starts surpassing initial estimates at 1.285 million units and 1.246 million units during January, while the Philly Fed manufacturing index jumped to fresh 33-year high at 43.3 for the current month, crushing consensus (18.0) and almost doubling January’s 23.6.

The data, however, did nothing to dent the bearish mood around the buck, which seems to have found some decent support around the 200-hour sma in the mid-100.00s for the time being.

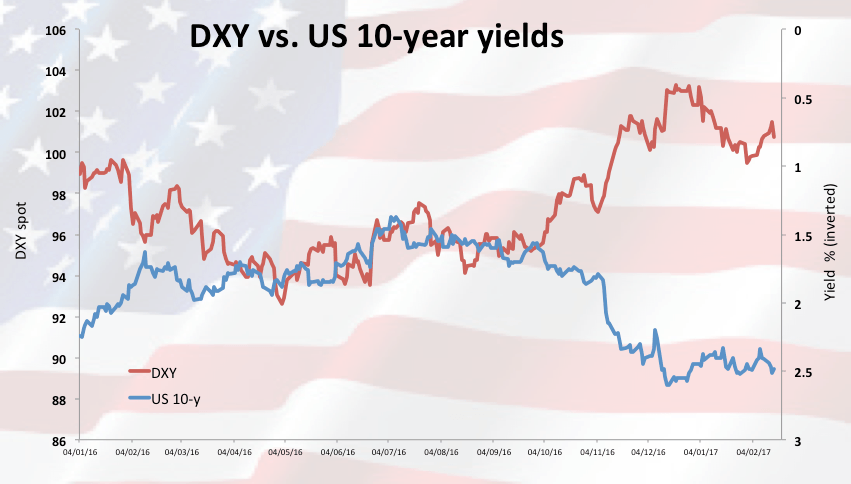

Anyway, the downside momentum in USD could probe to be just temporary, as expectations of a rate hike by the Federal Reserve at the March meeting remains on the rise following Yellen’s testimonies and supportive Fedspeak, while the recent up move in US yields add to the constructive prospects.

US Dollar relevant levels

The index is losing 0.33% at 100.75 facing the next support at 100.55 (low Feb.16) followed by 100.36 (20-day sma) and then 100.03 (low Feb.8). On the other hand, a breakout of 101.75 (high Feb.15) would target 101.95 (23.6% Fibo of the November-January up move) en route to 102.96 (high Jan.11).