Back

19 Nov 2018

Crude Oil WTI Technical Analysis: Bulls are alive and kicking targeting $59.33 a barrel

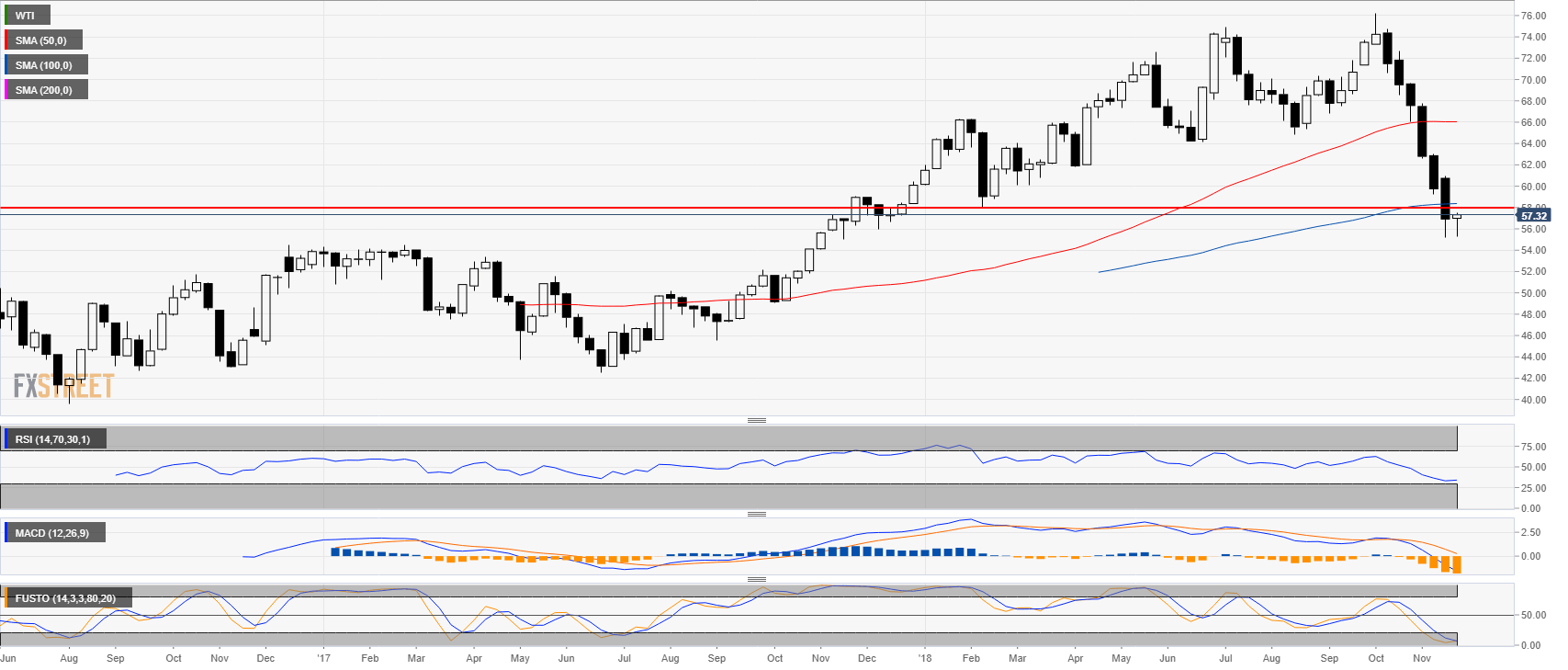

Crude Oil weekly chart

- Crude oil is in a steep bear trend as it erased the yearly gains.

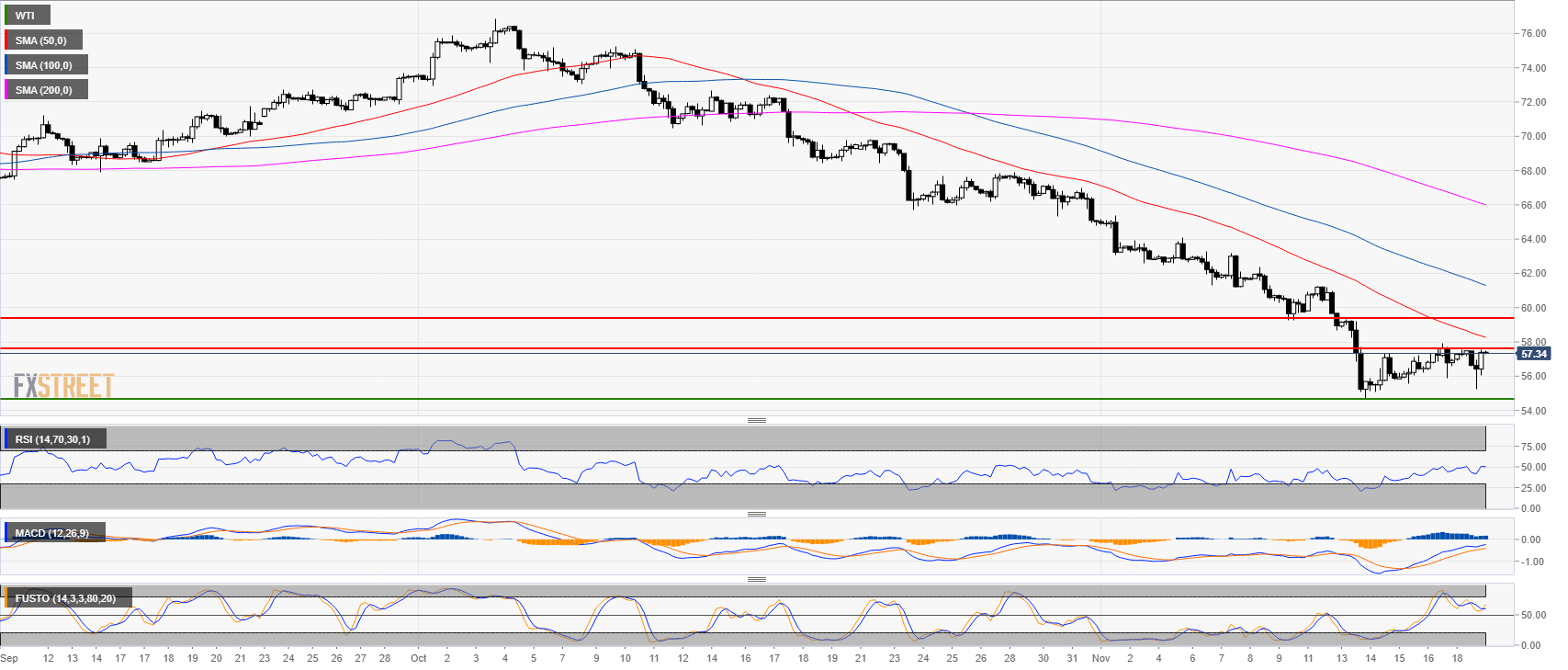

Crude Oil 4-hour chart

- Oil is trading is a sideways consolidation at yearly lows.

- The RSI, MACD and Stochastic indicators are constructive to the upside.

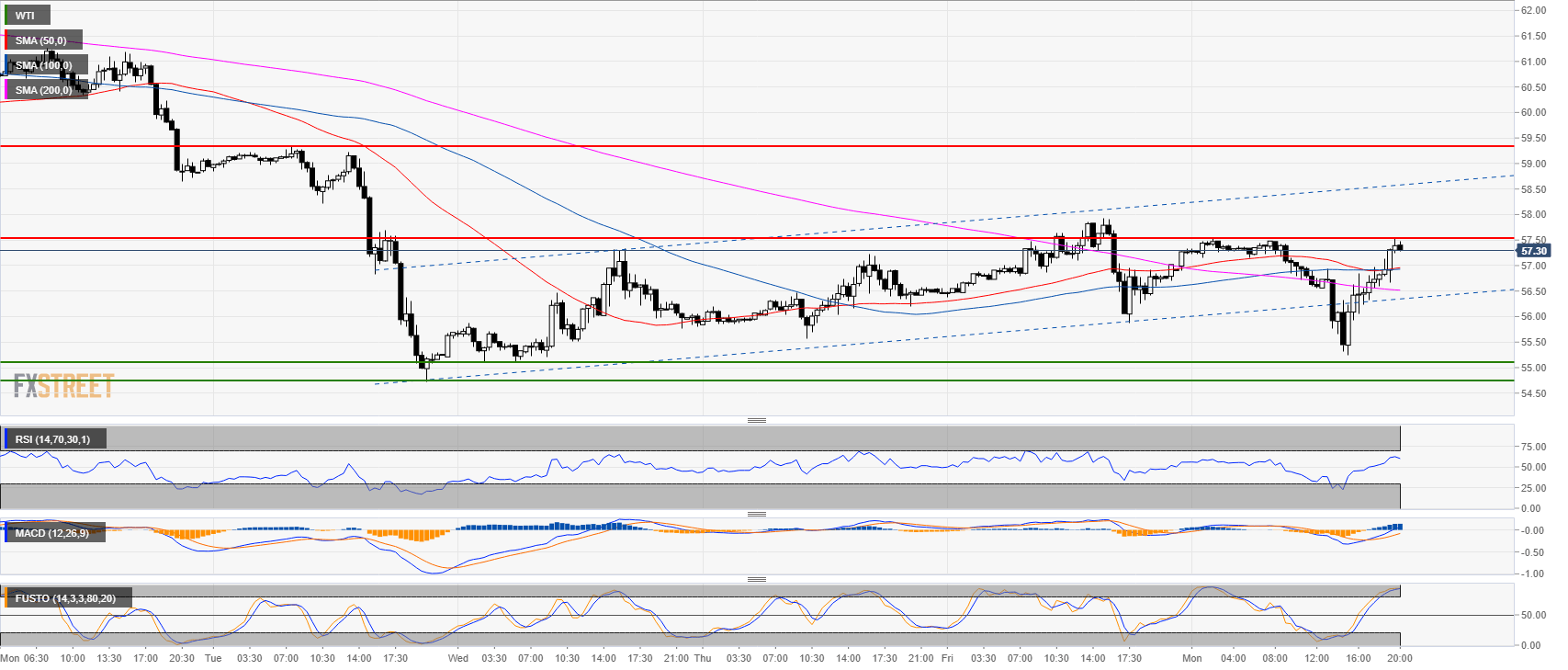

Crude oil 30-minute chart

- As expected oil found support just above 55.00 figure.

- Oil is back into the channel.

- The resistance to break is at 57.55. A move beyond would open the doors to 59.33

Additional key levels at a glance:

WTI

Overview:

Last Price: 57.32

Daily change: 5.0 pips

Daily change: 0.0873%

Daily Open: 57.27

Trends:

Daily SMA20: 61.57

Daily SMA50: 67.7

Daily SMA100: 68.03

Daily SMA200: 68.23

Levels:

Daily High: 57.34

Daily Low: 56.9

Weekly High: 60.93

Weekly Low: 55.21

Monthly High: 76.25

Monthly Low: 64.86

Daily Fibonacci 38.2%: 57.17

Daily Fibonacci 61.8%: 57.07

Daily Pivot Point S1: 57

Daily Pivot Point S2: 56.73

Daily Pivot Point S3: 56.56

Daily Pivot Point R1: 57.44

Daily Pivot Point R2: 57.61

Daily Pivot Point R3: 57.88