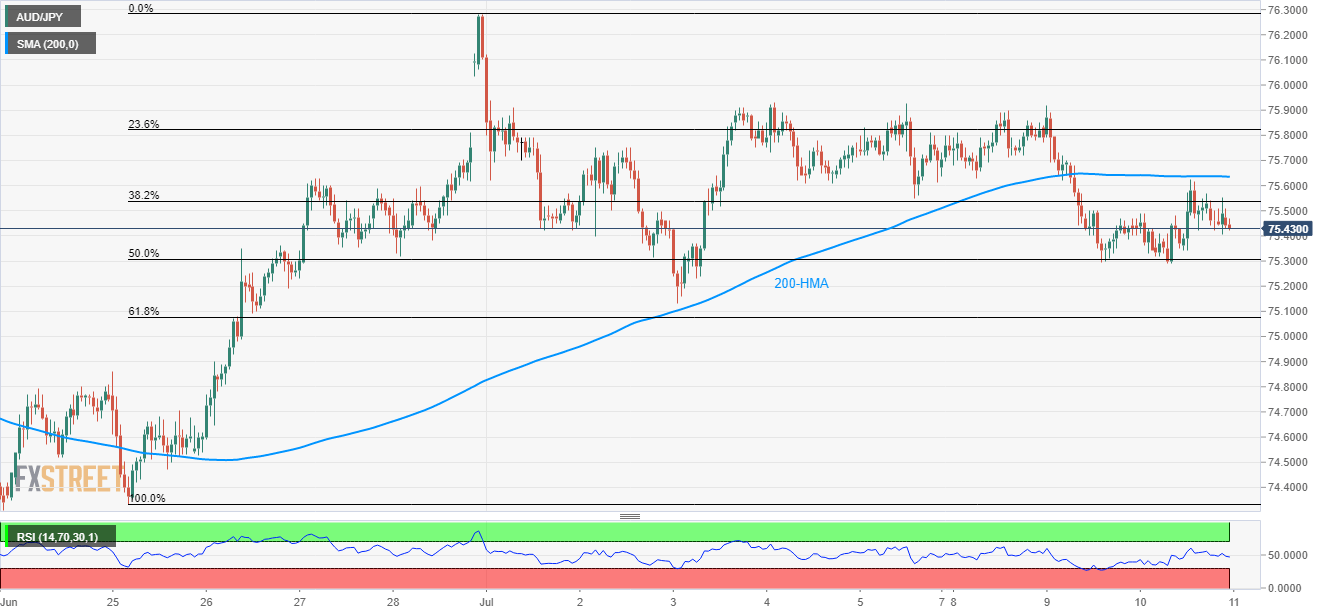

AUD/JPY technical analysis: Choppy between 200-HMA, 50% Fibo.

- The sustained trading below key MA, declining RSI favor the further downside.

- Sellers will seek a break of 50% Fibonacci retracement to aim for 75.13.

Despite bouncing off 50% Fibonacci retracement of late-June increase, the AUD/JPY pair couldn’t clear 200-hour moving average (HMA) as it drops to 75.43 during early Thursday.

The pair now drops towards 75.30 support comprising 50% Fibonacci retracement, a break of which can help sellers to aim for month’s low near 75.13.

Adding to the bears’ strength could be gradually declining but far from oversold territory levels of 14-day relative strength index (RSI).

Should prices slip beneath 75.13, 75.00 round-figure and June 25 low near 74.33 could flash on sellers’ radar.

Alternatively, an upside clearance of 75.64 encompassing 200-HMA can propel the quote to 75.92/94 multiple resistance area that holds the key to pair’s further run-up in the direction to 76.30.

AUD/JPY hourly chart

Trend: SIdeways