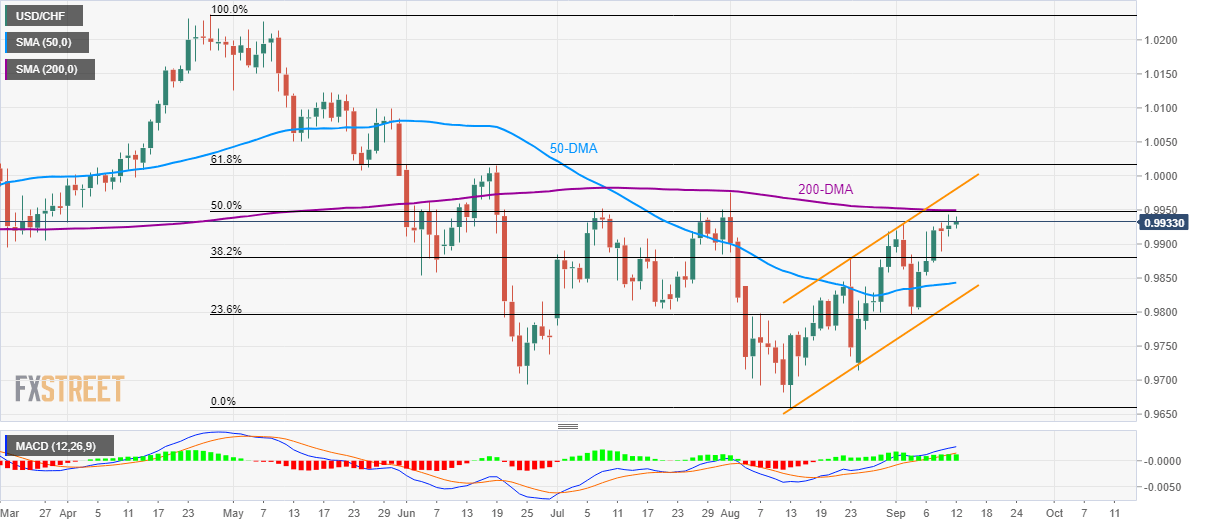

USD/CHF technical analysis: 200-DMA, 50% Fibo. restrict immediate upside

- USD/CHF follows a four-week-old rising trend-channel.

- 0.9950 resistance confluence holds the key for a run-up to channel’s upper-line.

USD/CHF again attempts to conquer 200-day simple moving average (DMA) as it takes the bids to 0.9940 ahead of Thursday’s European session open.

Increasing the strength of the resistance is 50% Fibonacci retracement of April-August declines, at 0.9950, a break of which will escalate the pair’s rise towards channel’s resistance-line, at 0.9980 now.

In a case bulls refrain from respecting 0.9980, the 1.000 psychological magnet and 61.8% Fibonacci retracement level of 1.00165 will be on their radars.

On the contrary, 38.2% Fibonacci retracement level of 0.9880 could restrict the pair’s near-term declines, a break of which could highlight 50-DMA level of 0.9845 and channel’s lower-line, at 0.9820.

If at all 0.9820 falls short of pulling the pair up, 23.6% Fibonacci retracement level near 0.9800 and late-August bottom surrounding 0.9715 could lure bears.

USD/CHF daily chart

Trend: pullback expected