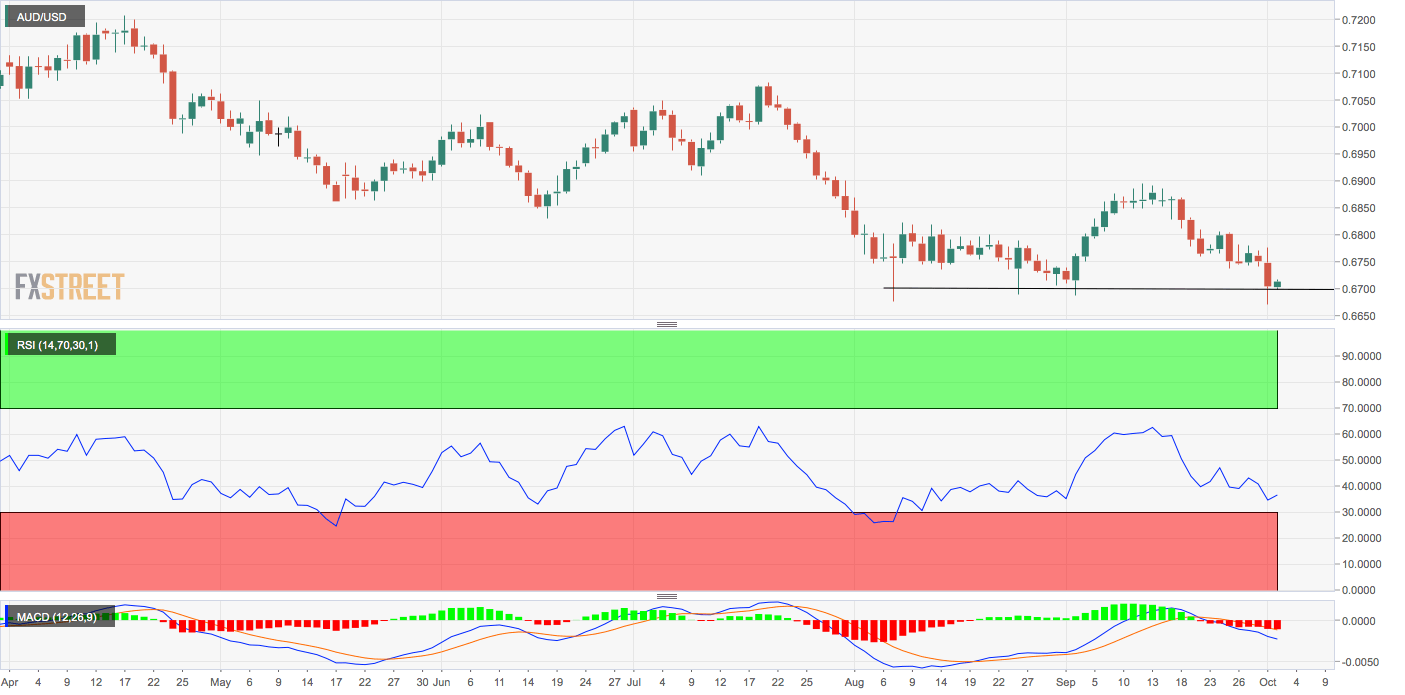

AUD/USD technical analysis: Recovering ground, bears again ran out of steam below 0.67

- AUD/USD has bounced from sub-0.67 levels for the fourth time in three months.

- The gains could be short-lived, as technical studies remain biased bearish.

AUD/USD is currently trading at 0.6715, still down 0.17% on the day, having hit a multi-year low of 0.6672 on Tuesday.

The pair faced selling pressure in the US trading hours on Tuesday after a key gauge of the US manufacturing data dropped to a 10-year low, triggering recession fears.

Sellers, however, ran out of steam below 0.67. Notably, the bears have failed to keep the pair below 0.67 at least three times since August.

The bounce from sub-0.67 levels, however, could be short-lived, as the technicals charts are biased bearish. For instance, the 5- and 10-day moving averages (MAs) are trending south.

The 14-day relative strength index is reporting bearish conditions with a below-50 print and the MACD histogram is indicating a strengthening of bearish momentum.

Also, heightened US recession fears will likely cap upside in the AUD and other riskier assets.

Daily chart

Trend: Bearish

Technical levels