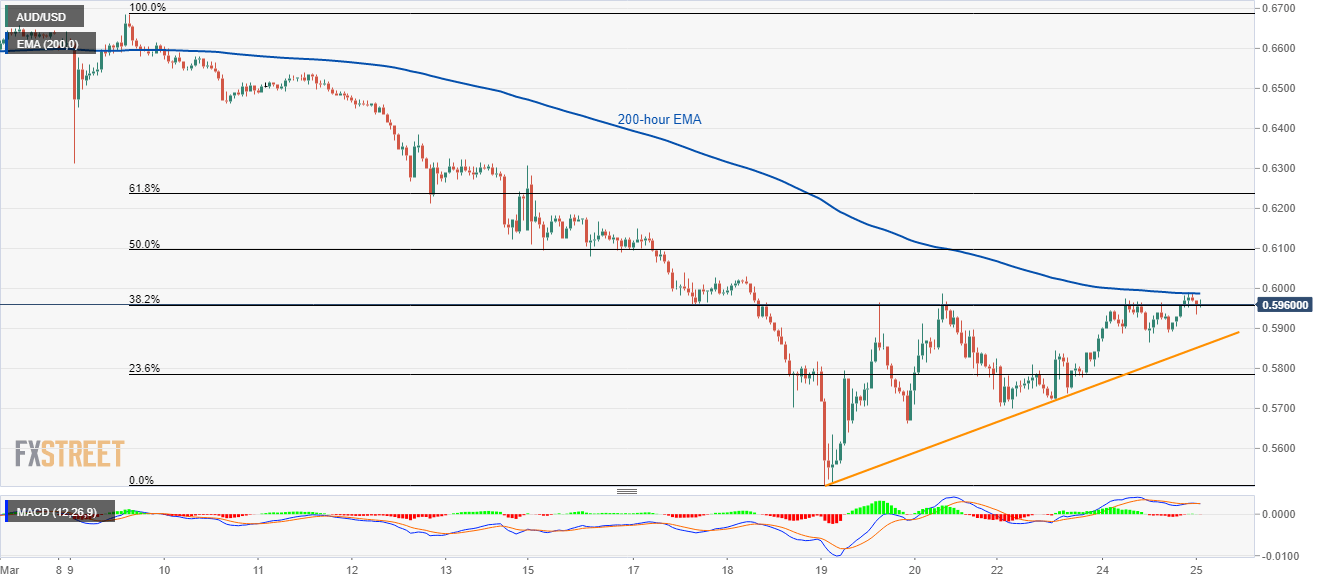

AUD/USD Price Analysis: Off session top, 200-hour EMA limit upside below 0.6000

- AUD/USD steps back from the one-week high.

- The short-term rising trend line keeps buyers hopeful.

- 50% and 61.8% Fibonacci retracement will be on the bulls’ radars during further upside.

AUD/USD steps back from one-week high to 0.5965 during Wednesday’s Asian session. In doing so, the pair registers failure to cross 200-hour EMA while staying above the ascending trend line since March 19, 2020.

While buyers are waiting for a sustained break above the EMA level, at 0.5990 now, 0.6000 round-figure will also act as the immediate upside barrier.

Should there be a clear run-up past-0.6000, 50% and 61.8% Fibonacci retracements of the pair’s declines between March 09 and 19, respectively around 0.6100 and 0.6240, will lure the buyers.

Alternatively, sellers will seek entry below the short-term support line, currently at 0.5850, to aim for a 23.6% Fibonacci retracement level of 0.5785.

In a case where the bears dominate past-0.5785, 0.5660 will be in the spotlight as it holds the key to the pair’s plunge towards 0.5500.

AUD/USD hourly chart

Trend: Bullish