Back

31 Mar 2020

Gold Futures: Downside seems shallow

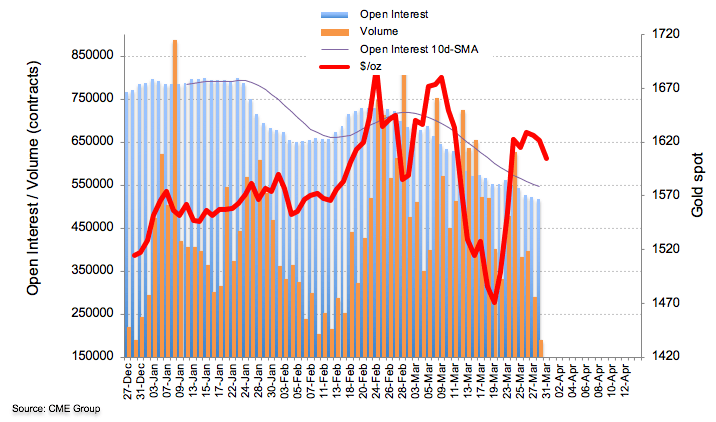

In light of preliminary figures for Gold futures markets from CME Group, traders scaled back their open interest positions for the fifth session in a row on Monday, this time by around 4.5K contracts. In the same direction, volume shrunk for the second consecutive day, now by around 100.3K contracts.

Gold faces interim support around $1,550/oz

The precious metal continues to trade on the back foot on Tuesday. The decline in prices of the ounce troy coupled with shrinking open interest and volume hint at the likeliness that further downside could be limited, leaving the $1,550 region as the next interim contention. In this area coincide a Fibo retracement of the December-March rally and the February’s low.