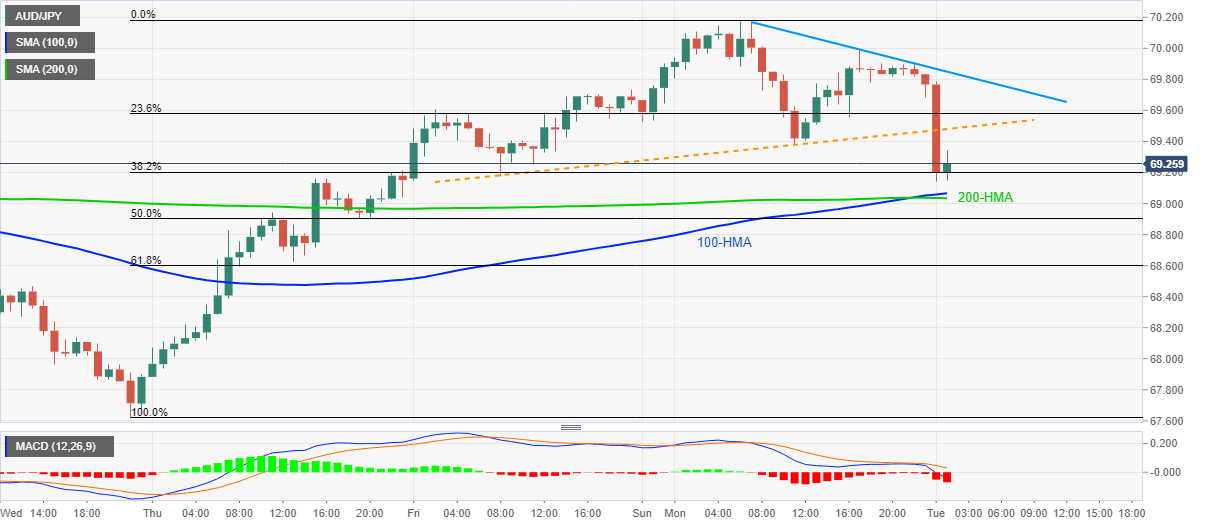

AUD/JPY Price Analysis: Pressured below 70.00 following China/Aussie data

- AUD/JPY extends downside break of previous support line after downbeat China inflation, Australian data.

- 100/200-HMA on the sellers’ radar amid bearish MACD.

- Buyers will have multiple upside barriers to justify their strength.

AUD/JPY drops to 69.15 amid the early Tuesday. The pair stretches the downside past-short-term support line, now resistance, following downbeat CPI/PPI from China while ignoring better than previous readings of National Australia Bank's Business Confidence and Business Conditions for April.

Read: China April CPI +3.3% YoY (Reuters poll +3.7% )

The pair currently declines towards a confluence of 100 and 200-HMA near 69.00, amid bearish MACD, a break of which can drag the quote further down towards 61.8% Fibonacci retracement of its May 06-11 upside, near 68.60.

Also Read: NAB Business Confidence Index bounces to -46 in April, AUD/USD remains heavy

Meanwhile, an upside clearance of the support-turned-resistance, at 69.50 now, will have to cross the adjacent falling trend line from Monday’s top around 69.85 to target 70.00 and the weekly top surrounding 70.20.

It should also be noted that a sustained break of 70.20 enables the quote to challenge March month top nearing 71.52.

AUD/JPY hourly chart

Trend: Bearish