Natural Gas Price: Extra rangebound seems likely

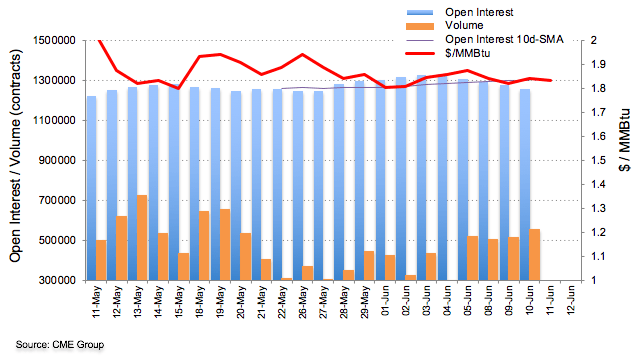

CME Group’s flash data for Natural Gas futures markets noted open interest decreased for yet another session on Wednesday, now by nearly 17.5K contracts. On the other hand, volume went up by around 36.6K contracts.

Natural Gas Prices Forecast

Natural Gas prices edged higher on Wednesday after bottoming out in fresh monthly lows near $1.73 during early trade. Diminishing open interest leaves the upside somewhat limited, as opposed to the uptrend in volume. Against this, price action looks inconclusive and therefore the continuation of the consolidative fashion looks the most likely scenario in the very near-term at least.

That said, Natural Gas faces the immediate hurdle at the 55-day SMA at $1.876 ahead of monthly peaks in the $1.90 neighbourhood and the key barrier at the $2.00 mark. On the downside, the 2020 lows in the $1.57 area emerges as the magnet for sellers in the near-term.