Back

9 Jul 2020

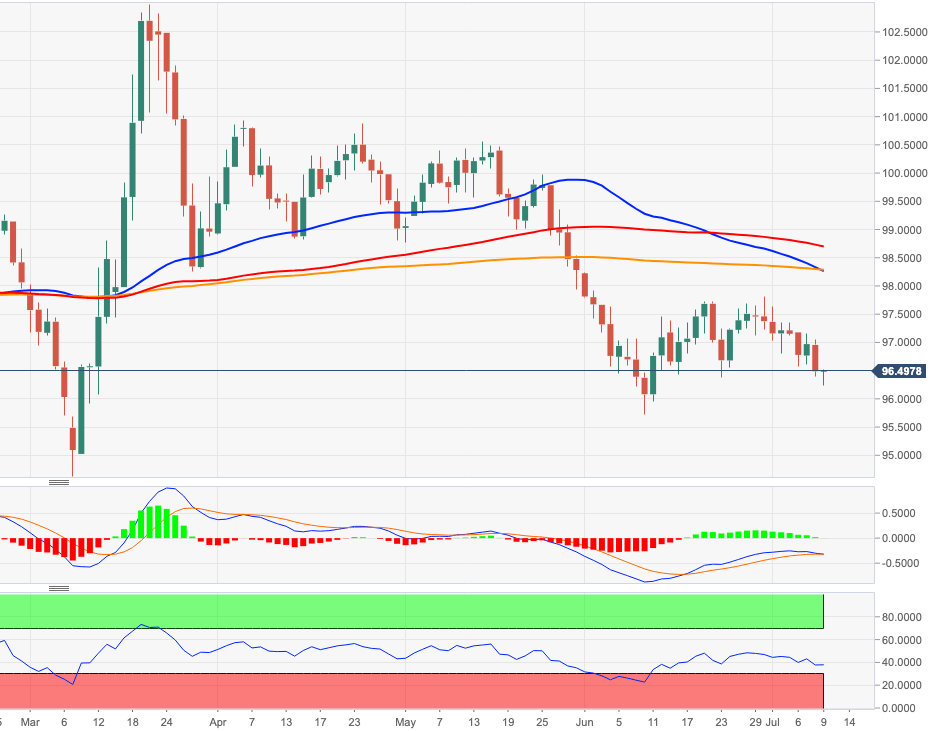

US Dollar Index Price Analysis: Rising bets for a test of 96.00 (and below)

- DXY breached the key 96.40 support earlier on Thursday.

- Further declines now expose the Fibo level in the 96.00 zone.

DXY has come under renewed and moderate selling pressure in past hours, breaking below the key support area in the 96.40/35 band.

Below this area is located a Fibo level (of the 2017-2018 drop) just above 96.00 the figure ahead of June’s low at 95.71.

The negative outlook on the dollar is expected to remain unaltered while below the 200-day SMA, today at 98.27.

DXY daily chart