CHF/JPY Price Analysis: Tug of war between risk-off currencies at 38.2% Fib

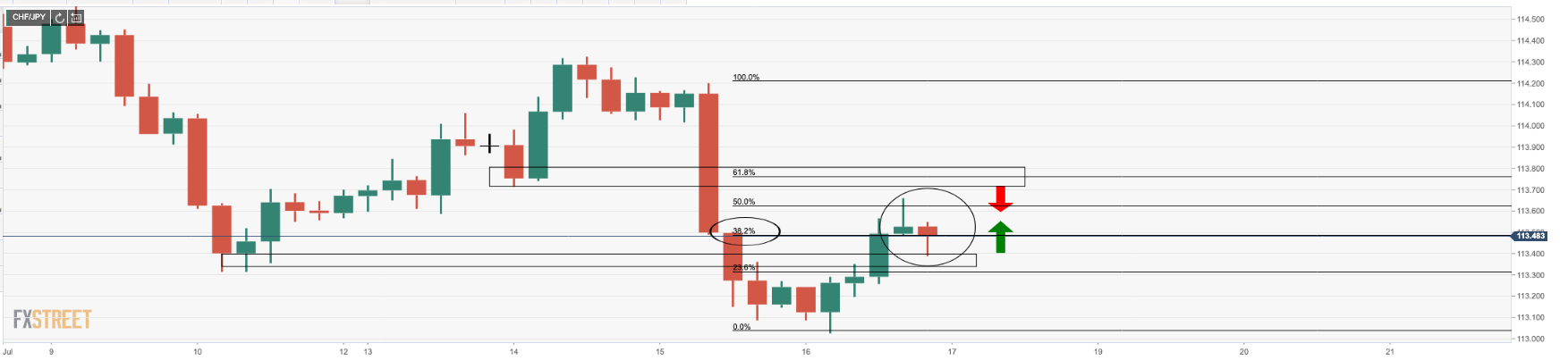

- CHF/JPY bears and bulls in a tug of war at a critically pivotal point on the 4HR chart.

- We are now at a crossroads and its do or die for the bears.

CHF/JPY is at a crossroads which has left conflicting pin-bars on the 4-hour charts.

The price action has been in favour of the bears on a weekly and daily outlook and there are just a few developments left in the near term charts that will call the seal for a convincing short playbook.

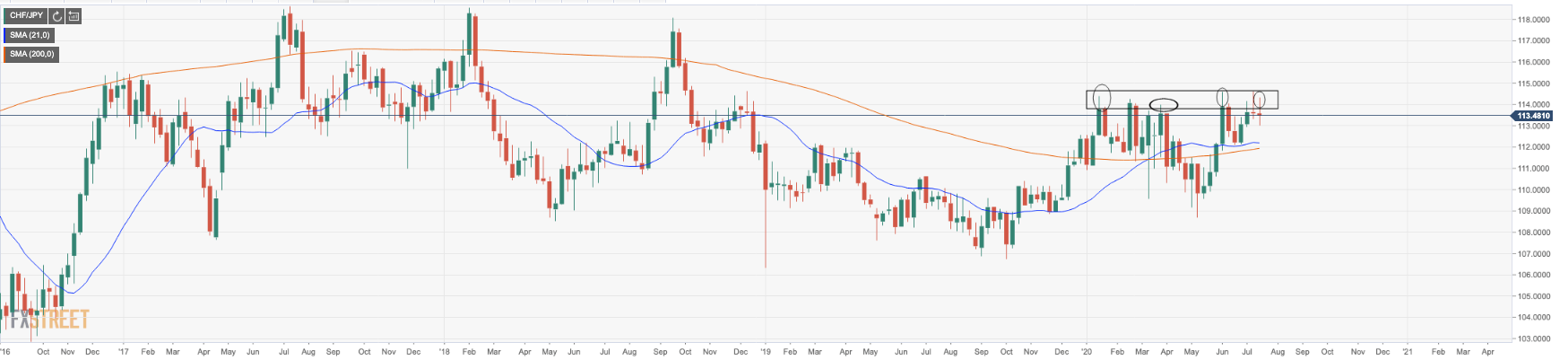

Starting with the weekly chart, we can see that the resistance has been tough for many weeks and price has been rejected multiple times.

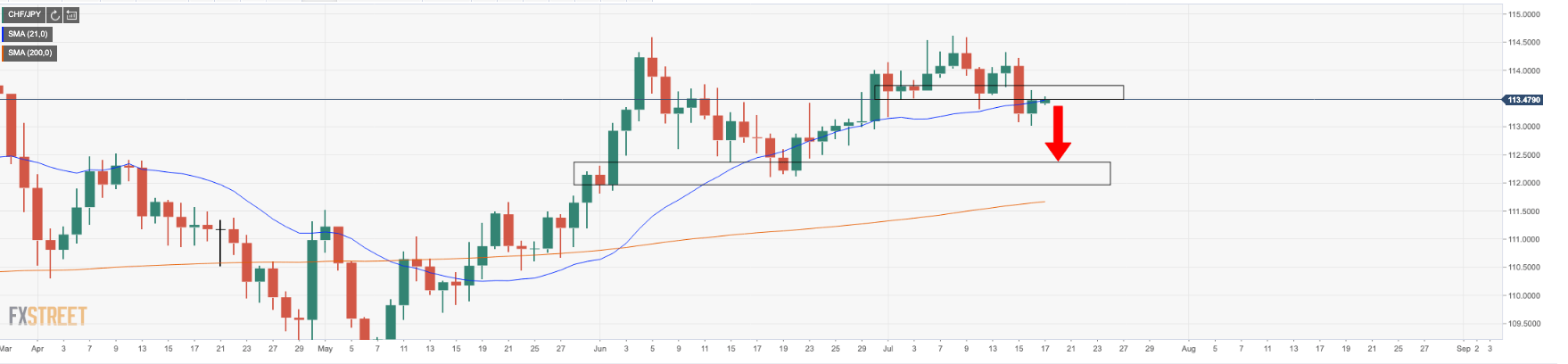

On the daily, we see that a head and shoulders pattern was completed:

The bears broke the support structure of the H&S and on a retest, if the old support holds, the runway will be open to the next structure.

Moving down to the four-hour tie frame, we are now at a crossroads and its do or die for the bears.

The 38.2% Fibonacci was a milestone from where bulls will look for a hold of support here seeking a break of the next structure to the upside.

However, committed bears will be looking for a discount at this juncture, stocking up for the next impulse to the downside.