USD/CAD Price Analysis: Sellers eye 200-SMA amid bearish technical setup

- USD/CAD accelerating downside towards 200-HMA.

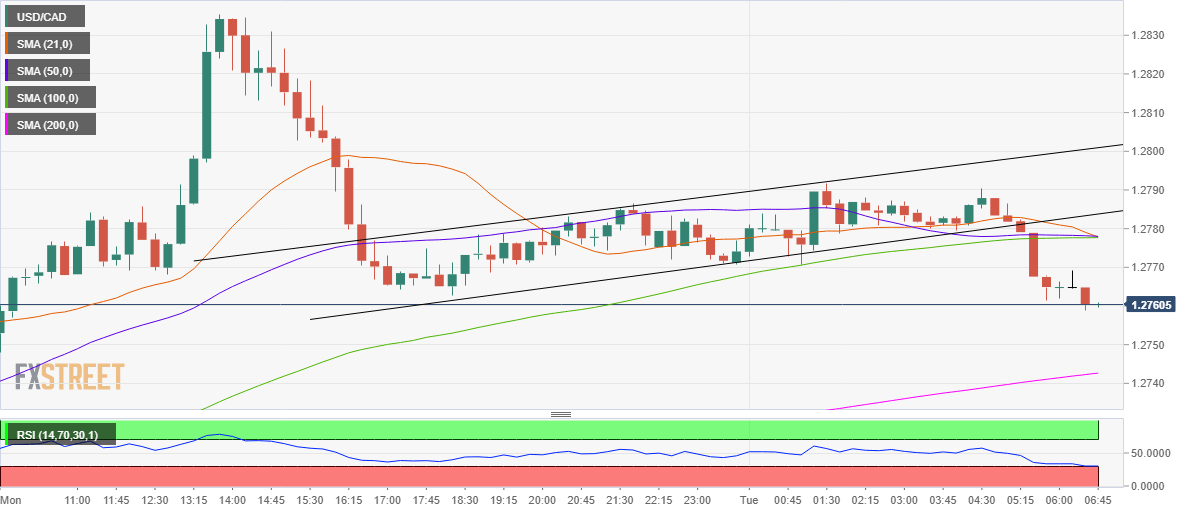

- A rising channel breakdown spotted on 15-minutes chart.

- 1.2778 is likely to keep the recovery attempts limited.

USD/CAD is feeling the pull of the gravity in early European trading, tracking the retreat in the US dollar alongside the Treasury yields.

Additionally, renewed strength seen in WTI prices seems to be boding well for the resource-linked loonie, as the major flirts with daily lows above the midpoint of the 1.2700 level.

The dollar’s pullback also collaborates with the rising channel breakdown on the 15-minutes chart, which is likely to exacerbate the pain in USD/CAD.

The bears now target the 200-simple moving average (SMA) support at 1.2742, with the Relative Strength Index (RSI) probing the oversold territory, at the time of writing.

The decline gathered steam after the price cut through the critical support at 1.2778, which the convergence of the 50 and 100-SMAs.

Any pullbacks will be likely restricted by the latter. The path of least resistance appears to the downside, as the 21-SMA is on the verge of crossing the 50 and 100-SMAs from above, confirming a bearish crossover.

USD/CAD: Hourly chart

USD/CAD: Additional levels