USD/CAD Price Analysis: Corrective pullback fades below 1.2470 key hurdle

- USD/CAD fizzles bounces off multi-month low flashed the previous day.

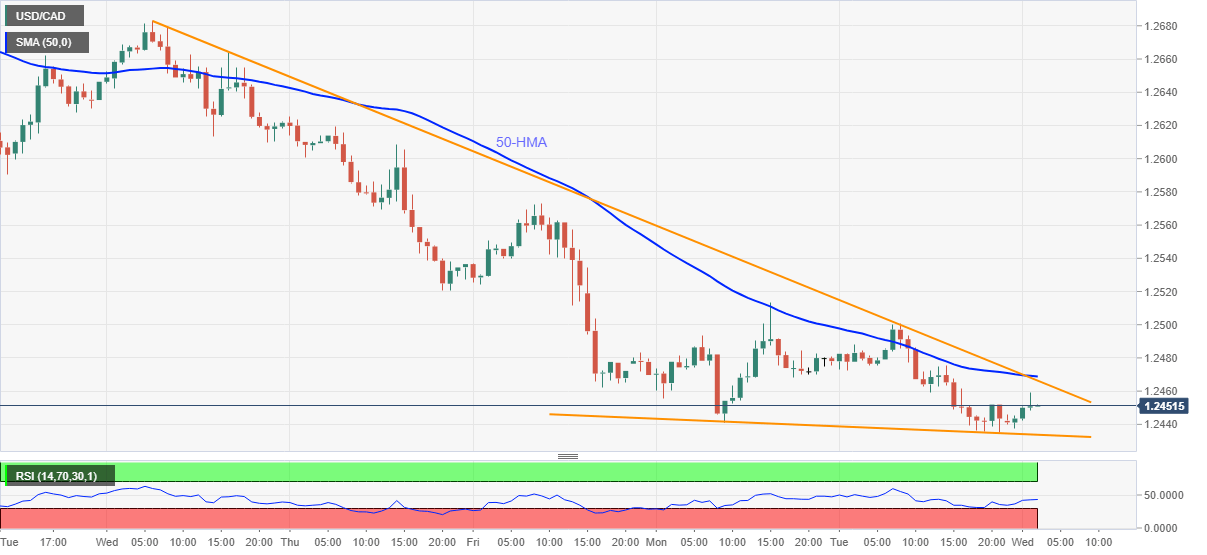

- 50-HMA, one-week-old falling trend line guards immediate upside.

- Fresh selling awaits downside break of short-term support line.

USD/CAD eases from an intraday high of 1.2459 to 1.2453 during early Wednesday. In doing so, the quote fails to extend the previous day’s U-turn from the weekly support line after declining to the fresh low since February 2018.

Given the weak RSI conditions giving background music to the USD/CAD failures to recover, the quote is likely aiming at the immediate support line, at 1.2434 now, while also targeting the 1.2400 during the further downside.

Should USD/CAD bears keep reins past-1.2400, 2018’s yearly bottom near 1.2250 will be the key to watch.

Meanwhile, corrective pullback needs to cross the 1.2470 resistance confluence, comprising 50-HMA and a falling trend line from March 10, to trigger short-term recovery moves toward the 1.2500 round-figure.

However, any further upside will have to stay above March 11 low around 1.2520 before trying to convince the bulls.

USD/CAD hourly chart

Trend: Bearish