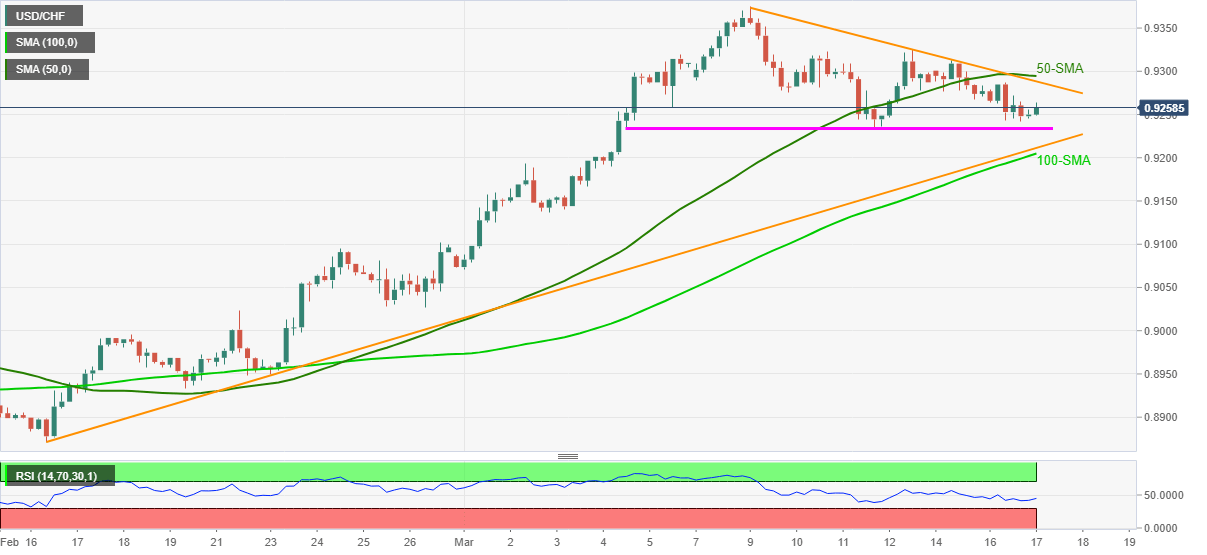

USD/CHF Price Analysis: Recovery moves lack strength below 0.9300

- USD/CHF prints mild gains while fading pullback from intraday high.

- Two-week-old support restricts immediate downside ahead of the key support confluence near 0.9200.

- 50-SMA, short-term falling trend line tests intraday buyers.

- Key SMAs, normal RSI conditions suggest choppy moves ahead.

USD/CHF stays firm around 0.9260, up 0.13% intraday amid early Wednesday. In doing so, the quote defies the recent U-turn from the day’s high of 0.9263 while also snapping the two-day downtrend marked so far in the week.

It should, however, be noted that the USD/CHF price consolidates early month gains inside 50 and 100-SMA, amid a lack of extreme RSI conditions, which in turn signals continuation of the grind to the south.

As a result, a horizontal area comprising lows marked since March 04, around 0.9235-30, gains immediate attention of short-term USD/CHF sellers. Though, any further weakness will have to break a confluence of 0.9210-9200, comprising 100-SMA and an ascending trend line from mid-February, to convince the bears.

Meanwhile, a downward sloping trend line from the previous Tuesday and 50-SMA close to the 0.9300 threshold precedes Friday’s top near 0.9325 to test the USD/CHF bulls.

If at all the USD/CHF upside stays intact past-0.9325, the monthly high near 0.9375 and the 0.9400 round-figure can lure the buyers.

USD/CHF four-hour chart

Trend: Sideways