WTI firm above daily resistance, eyes on OPEC+

- US oil was slightly higher on Monday in thinner trade.

- Traders will look to today's OPEC + meeting.

WTI was 0.43% higher on Monday following a rally from a low of $66.43 to a high of $67.38.

Brent crude futures settled up 60 cents, or 0.9%, at $69.32 a barrel, off the session high of $69.82. WTI rose 0.9% and last traded at $66.91 a barrel. Both contracts were set for a second monthly gain.

There is increased optimism that fuel demand in the vacation season will grow in the next quarter.

Today's OPEC+ meeting will be the focus for the sessions ahead.

OPEC+ is expected to stay the course on plans to gradually ease supply cuts until July. A Joint Technical Committee (JTC) for the alliance kept its global oil demand growth forecast for 2021 unchanged at about 6 million barrels per day, two sources from the group told Reuters on Monday.

Overall, analysts expect oil demand growth to outstrip supply despite the possible return of Iranian crude and condensate exports. Iran has been in talks with world powers since April with respect to the 2015 nuclear pact.

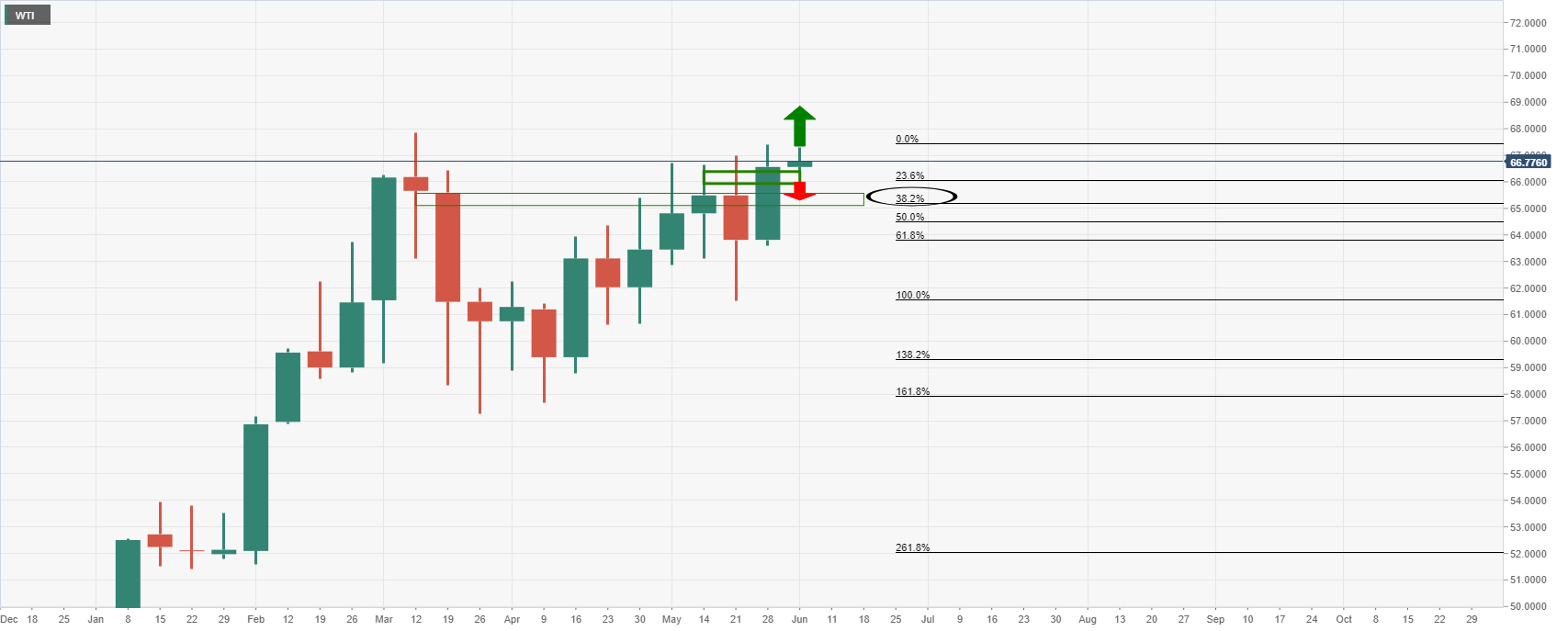

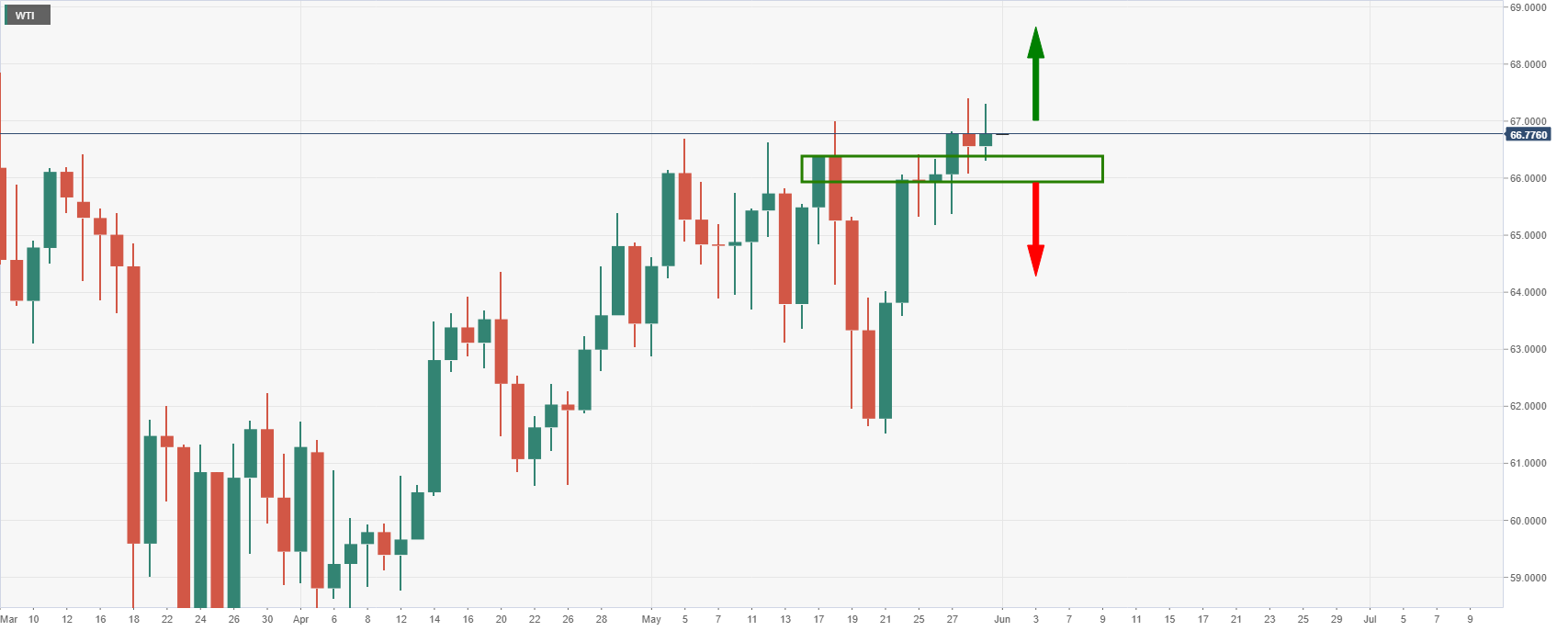

WTI technical analysis

Bulls have been chipping away into the daily resistance and printed a fresh daily high of 67.49 on Friday which opens risk to a continuation for the week ahead.

Meanwhile, a break of daily support will open prospects of a deeper correction to the 38.2% Fibonacci of the weekly bullish impulse comes in at 64.97.